Transforming Fleet Risk Data into Actionable Insight at Aon

Executive Summary

Aon Fleet Risk Intelligence — a B2B platform delivering fleet risk insights for brokers, insurers, and large fleet operators.

Role

UX Lead — UX strategy, research, design execution, and optimisation.

Goal

Improve usability, accessibility, and scalability while enabling faster, more confident risk decisions.

Business Problem

The platform surfaced large volumes of risk data, but users struggled to interpret insights quickly — particularly as fleet size increased and the underlying risk model evolved.

This created four strategic risks:

Slower decision-making in safety-critical workflows

Reduced adoption among larger enterprise fleets

Erosion of trust during the transition to a unified AI risk model

Increased support and training overhead

Context

Product

Aon Fleet Risk Intelligence — a B2B analytics platform serving insurers, brokers, and large fleet operators.

Role

UX Lead — accountable for UX strategy, research direction, design execution, and continuous optimisation.

Mandate

Following Aon’s acquisition of HUMN, the platform needed to scale for enterprise clients while maintaining trust, usability, and regulatory clarity in a data-heavy, risk-sensitive environment.

Impact

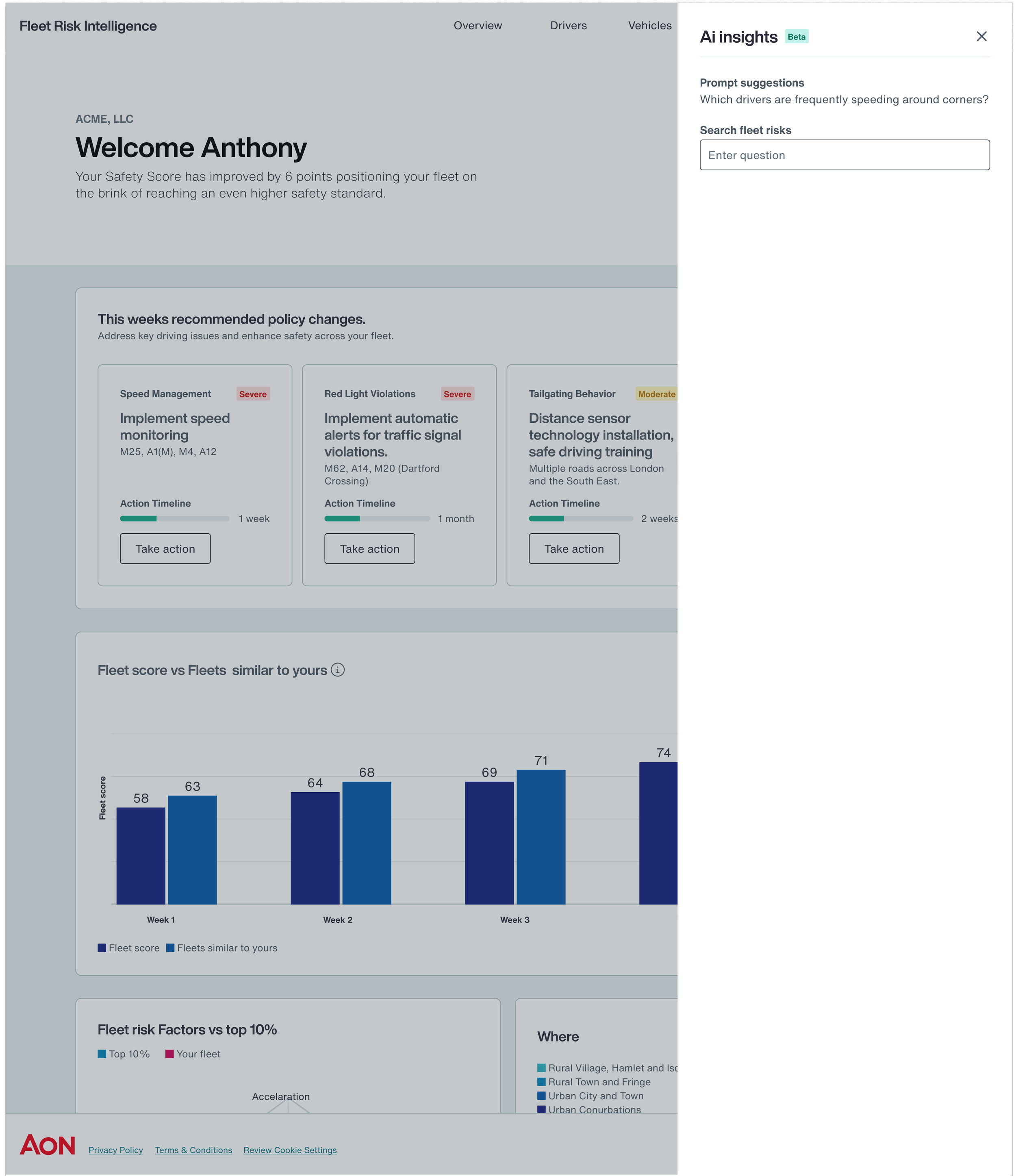

40% reduction in decision time for fleet managers (5 → 3 minutes per risk assessment), enabling faster, more confident operational decisions

20% uplift in user satisfaction, driven by improved usability, accessibility, and clarity across core workflows

Enterprise-scale readiness achieved through modular, role-based dashboards optimised for large fleets

Increased trust in AI-driven risk models by making scoring logic transparent and explainable

Reduced cognitive load across the platform through progressive disclosure and prioritised insights

Context & Business Stakes

The Scale

Organisation

Aon — a global professional services firm providing risk, insurance, and human capital solutions to enterprise clients worldwide.

Product Environment

Fleet Risk Intelligence operates within a highly regulated, data-intensive ecosystem, supporting insurers, brokers, and large commercial fleets with safety-critical decision-making.— Former Customer

Operating Context

Enterprise B2B platform with complex stakeholder needs

AI-driven risk models influencing operational and insurance outcomes

Strong emphasis on trust, explainability, and compliance

Post-acquisition integration following Aon’s acquisition of HUMN

The Challenge

When I stepped into the role, the platform was delivering valuable data but struggling to support fast, confident decisions at enterprise scale.

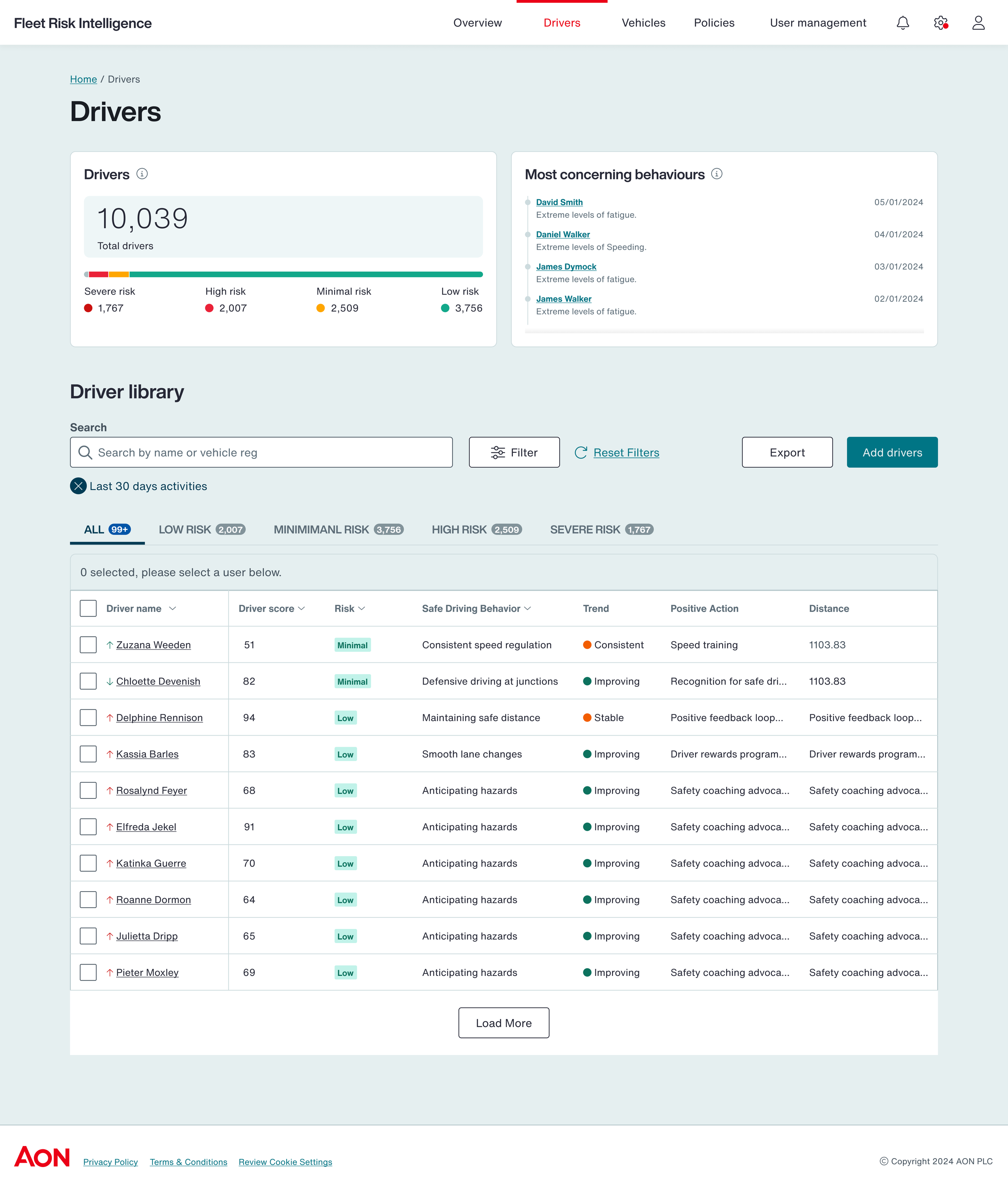

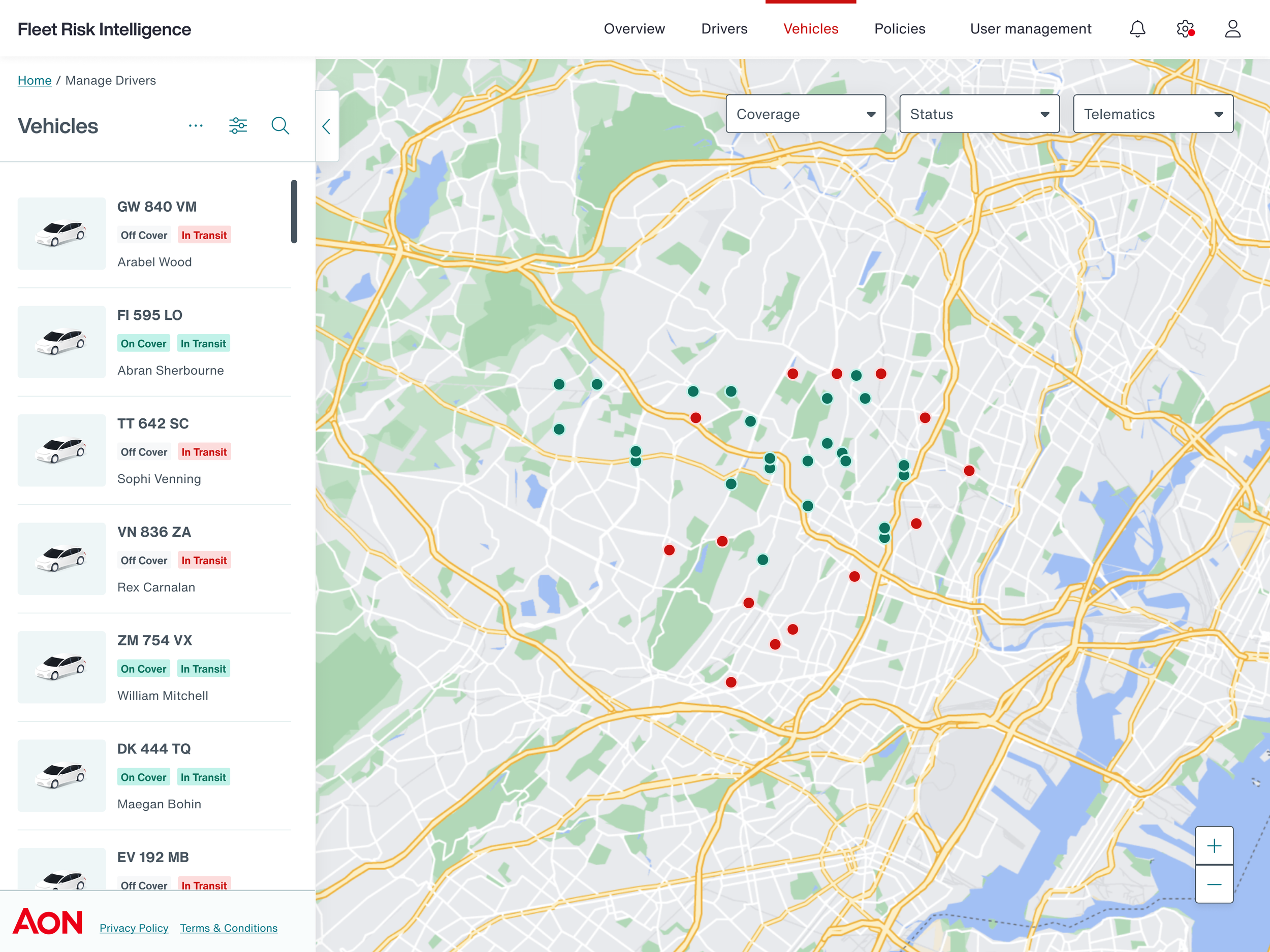

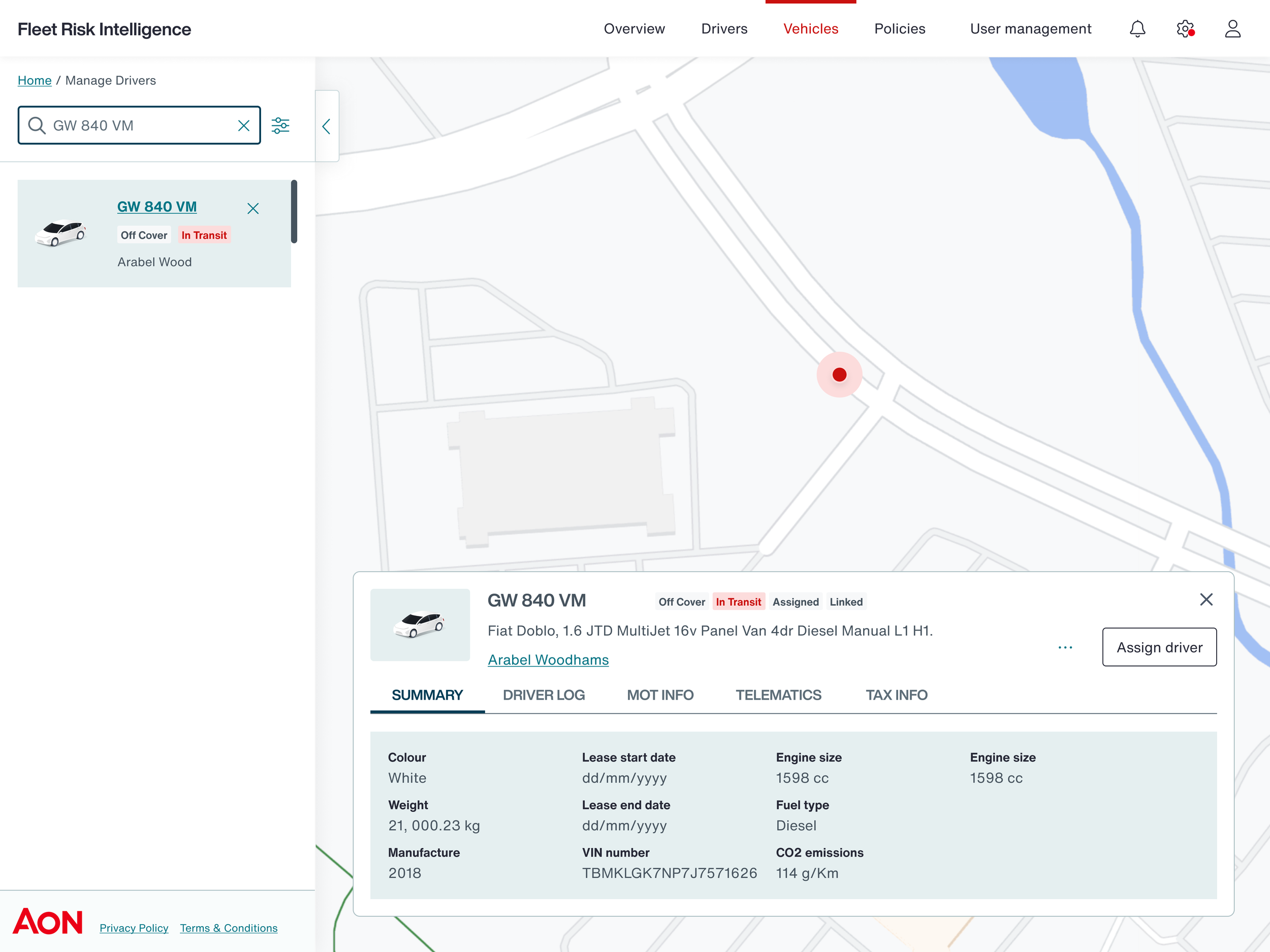

Key risks emerged across usability, scalability, and trust:AreaProblemBusiness RiskData InterpretationComplex visualisations slowed insight discoveryDelayed decision-making in safety-critical workflowsScalabilityDashboards optimised for smaller fleetsReduced adoption by large enterprise clientsRisk Model EvolutionShift to a unified AI model lacked clarityErosion of trust in risk scoresCognitive LoadExpanded risk bands increased complexityHigher training and support overheadMobile UsabilityDesktop-first experiencesLimited effectiveness for on-the-go users

The Opportunity

This moment created a clear strategic opportunity for design leadership:

Enterprise differentiation

Turn complex risk analytics into a clear, decision-grade experience that competitors struggled to deliver.

Trust as a competitive advantage

Use UX to make AI-driven insights transparent and explainable in a regulated environment.

Scalability without complexity

Enable large fleets to manage risk efficiently without increasing cognitive or operational load.

Operational efficiency

Reduce manual analysis and reporting through automation and clearer insight delivery.

Strategic Assessment

Through stakeholder interviews, research synthesis, and competitive analysis, I identified three core constraints limiting platform effectiveness:

Insight latency

Users needed answers quickly, not comprehensive dashboards.

Cognitive overload

Expanding from 3 to 5 risk bands increased complexity without additional explanation.

Opaque intelligence

AI-driven scores were valuable, but insufficiently explained to support trust and action

Design Strategy

I reframed the UX around decision quality and speed, not data volume.

Strategic Principles

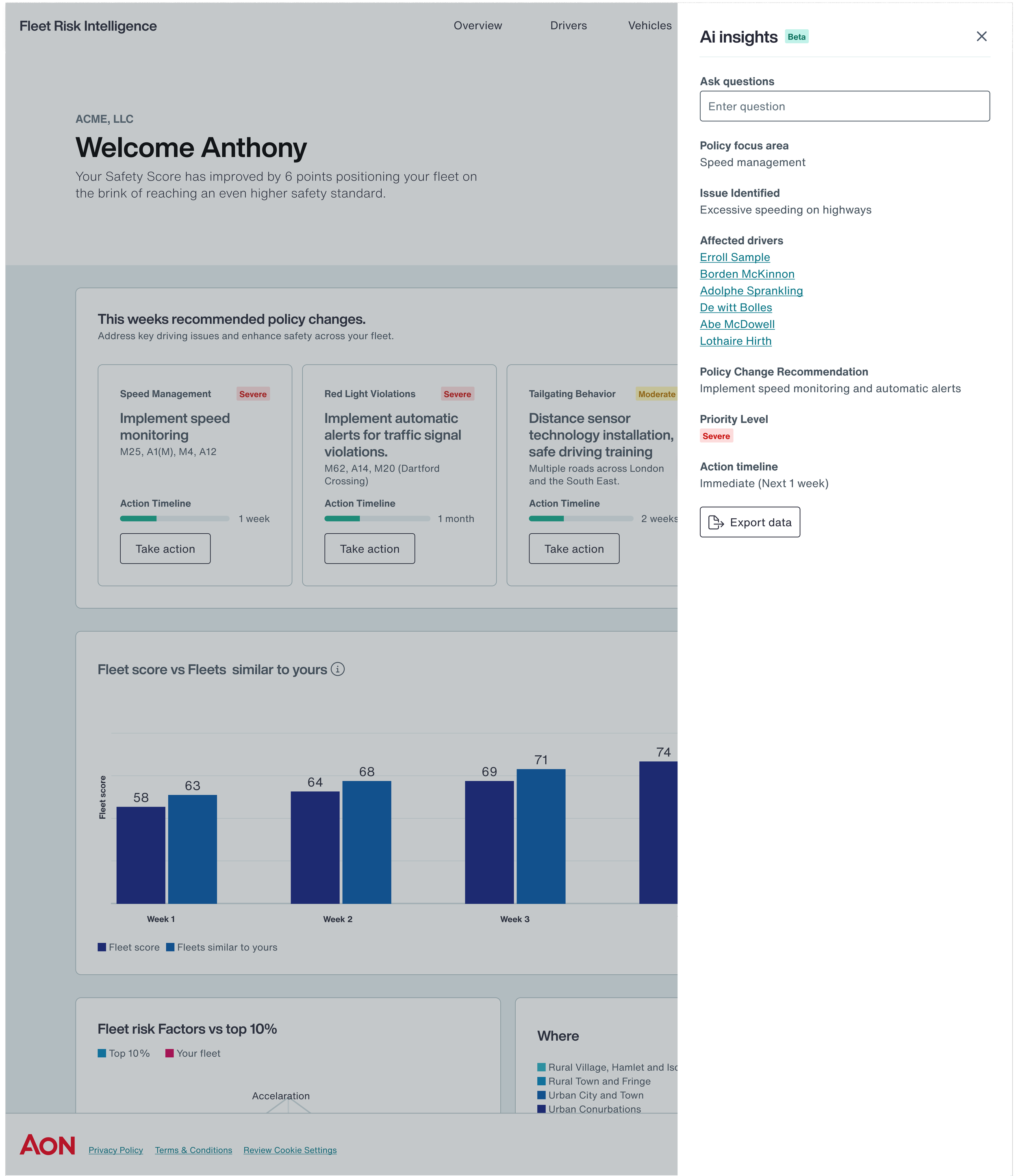

• Insight first, detail on demand

• Explainable AI as a UX responsibility

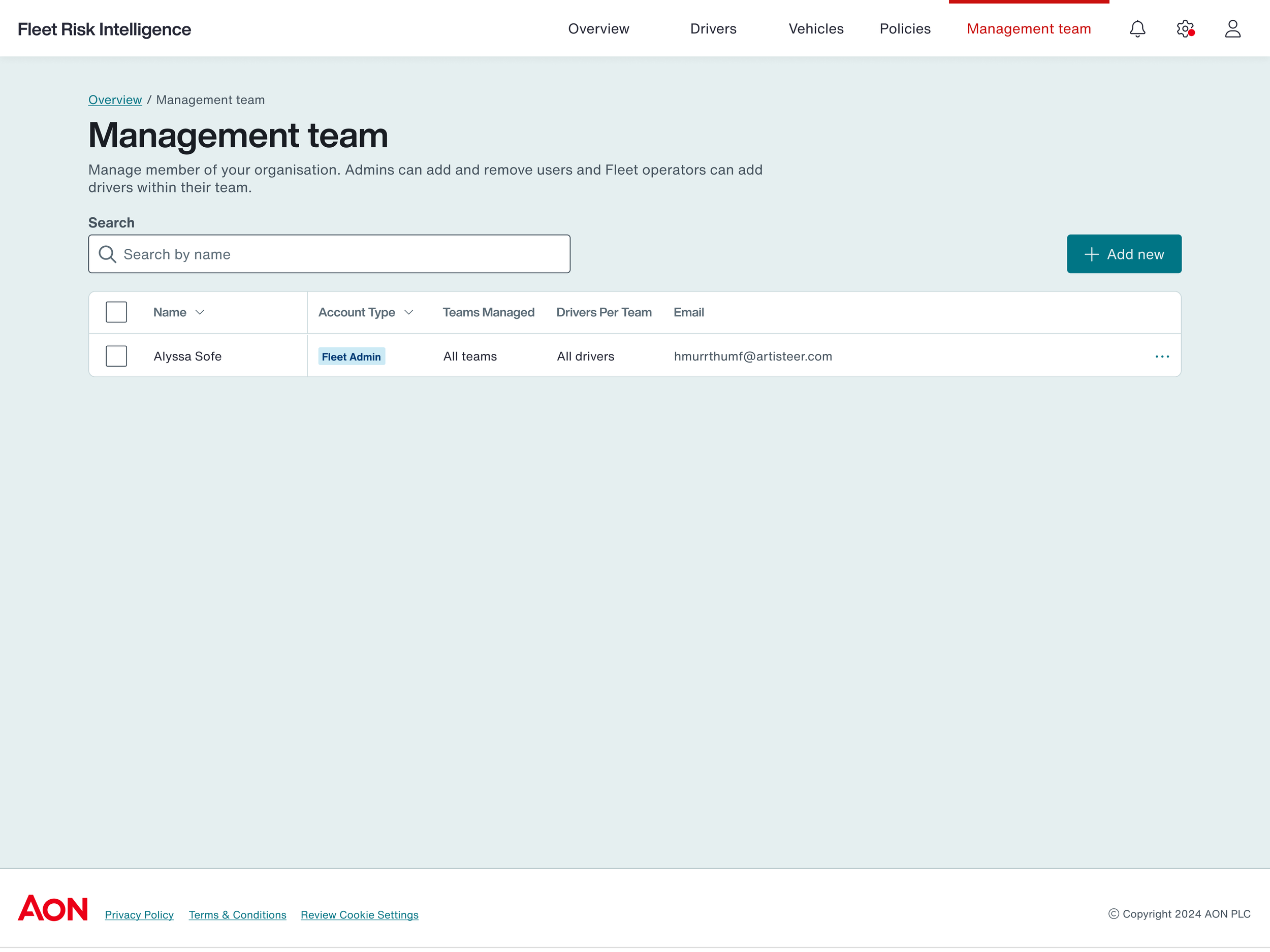

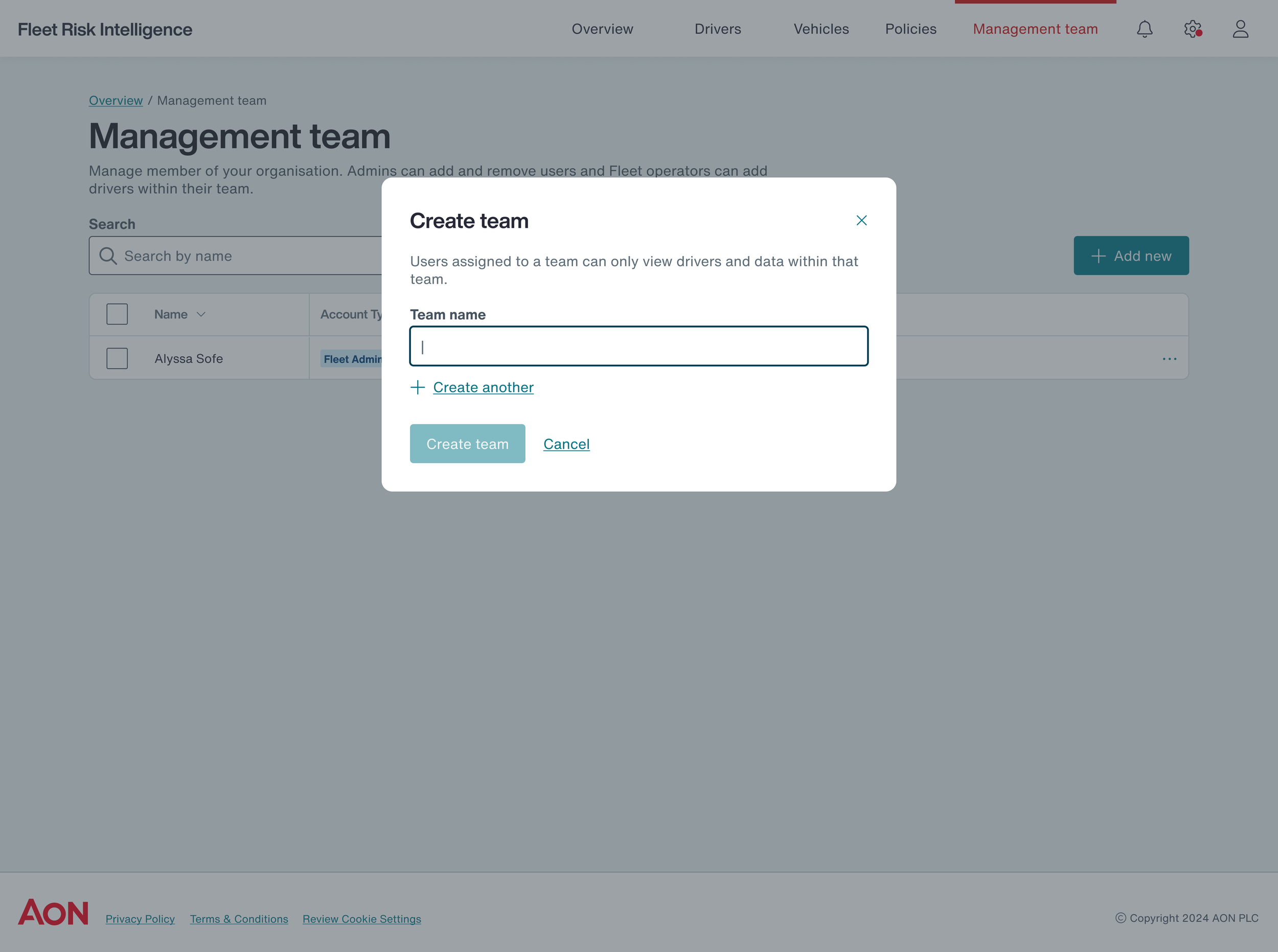

• Role-based experiences for enterprise scale

•Accessibility and clarity as risk-mitigation tools

Execution & Leadership

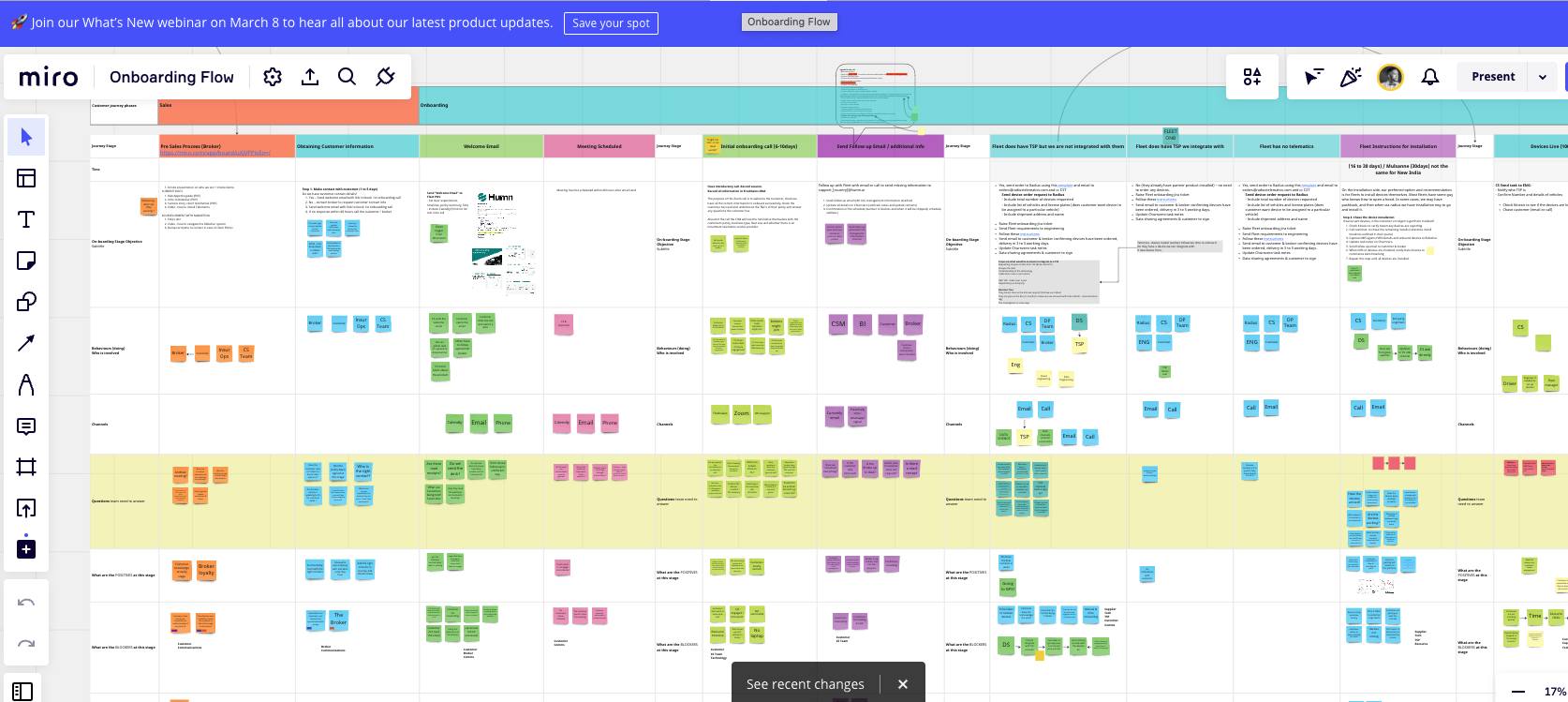

I led cross-functional design sprints with product, data science, and engineering to align around shared outcomes.

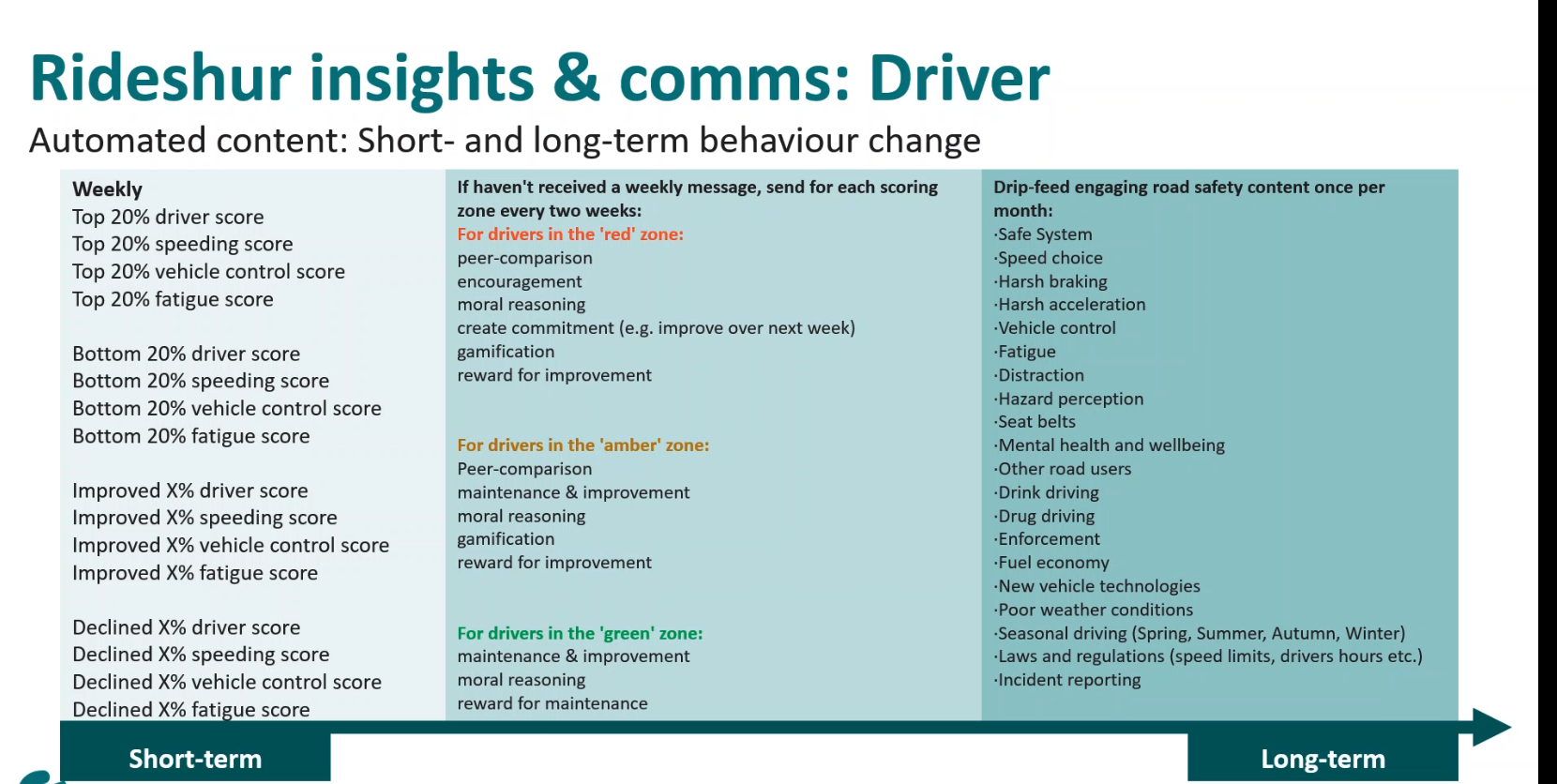

Key initiatives included:

Simplifying visualisations to highlight decision-critical signals

Introducing modular, role-based dashboards for managers and drivers

Implementing progressive disclosure to manage data density

Designing AI transparency patterns explaining risk scores and predictions

Automating reports and notifications to reduce manual analysis

Optimising mobile workflows for real-world fleet usage

All solutions were delivered within Aon’s global design system, with new components introduced only where enterprise needs required it.

Measurement & Validation

Benchmarking Pre-Improvement Metrics

Leading metrics - DAU, WAU, Reports opened by fleet managers and drivers,

Time to assess risk per Driver/fleet ( minutes taken to interpret dashboard insights).

User-reported time estimates from fleet managers (via surveys and from customer success managers).

Number of steps/clicks required to complete a risk assessment.

Lagging metrics - improvement Fleet/ Driver score

What this means in practice

Fleet managers used to take 5 minutes to assess risk, they now take only 3 minutes, reducing cognitive load and decision-making time.

The UX improvements (e.g., better visualizations, automated insights, progressive disclosure) contributed to this faster analysis.

Validated via usability tests, analytics (session duration, click reduction), or user feedback.

The platform shifted from a data-heavy reporting tool to a decision-support system designed for enterprise scale.