Scaling HUMN’s Insurtech Platform into a Trustworthy, Growth-Ready Product.

Executive Summary

HUMN — an insurtech focused on improving driver behaviour, fleet safety, and insurance outcomes using connected data and AI.

Product Environment

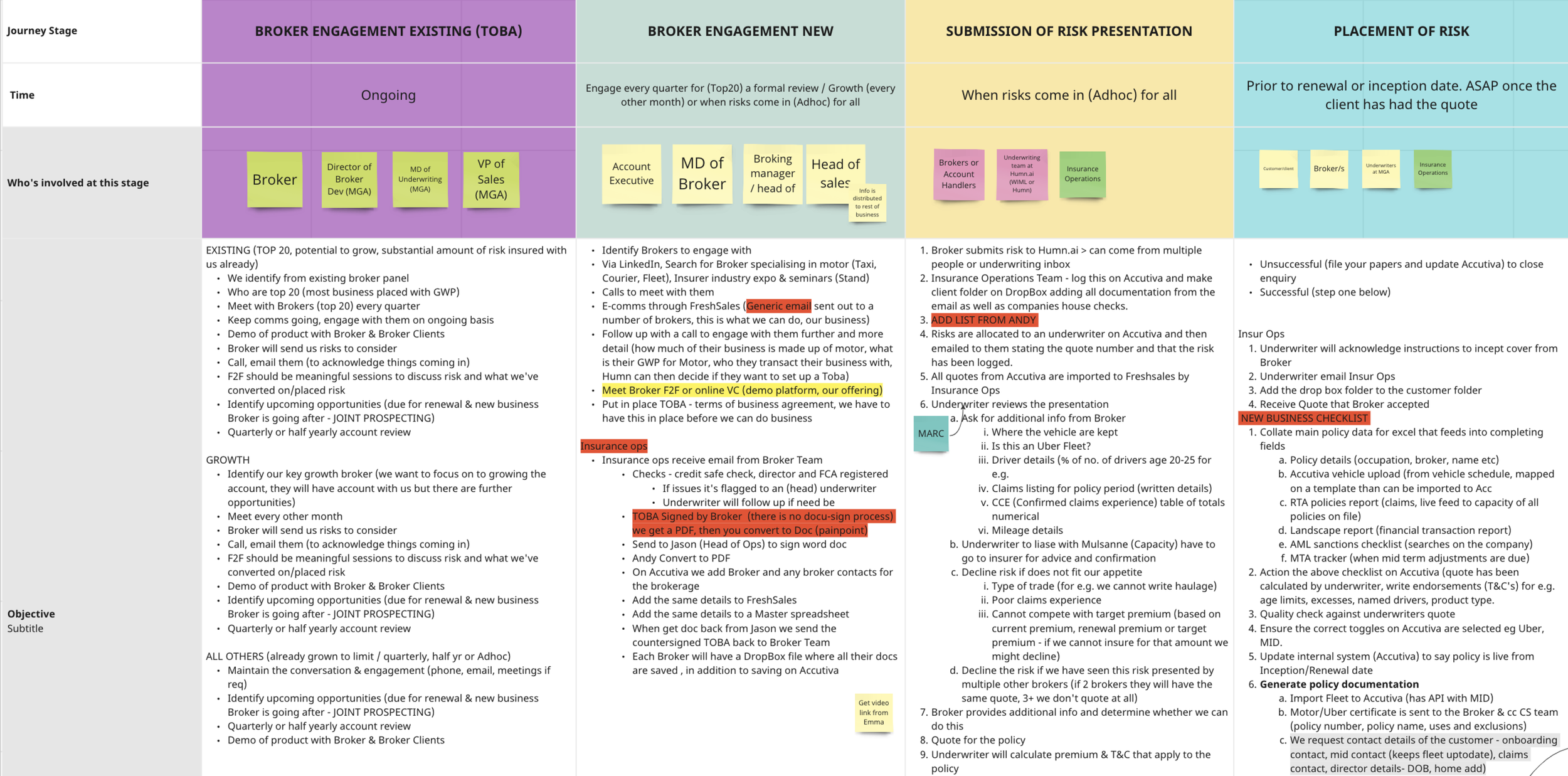

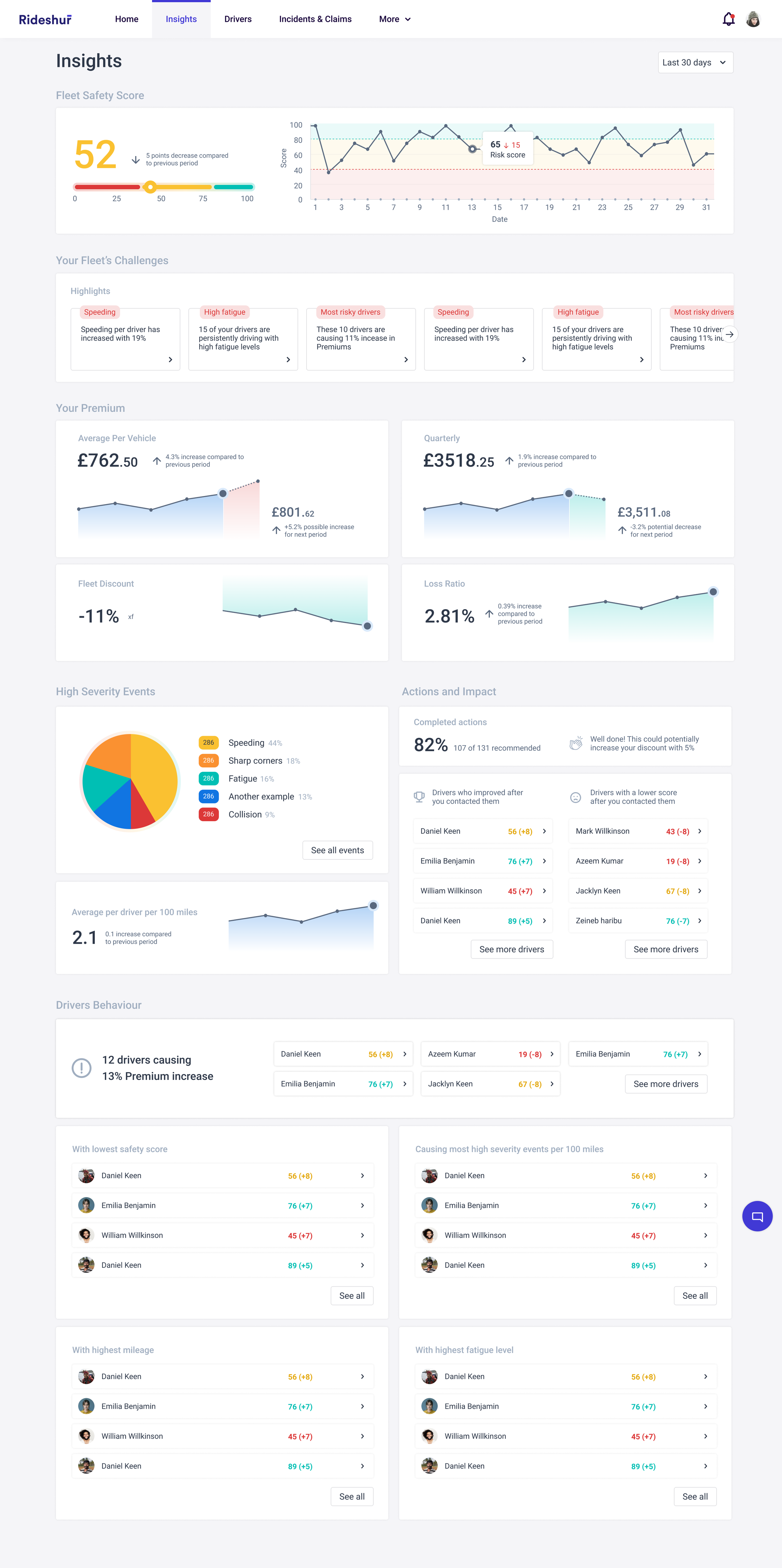

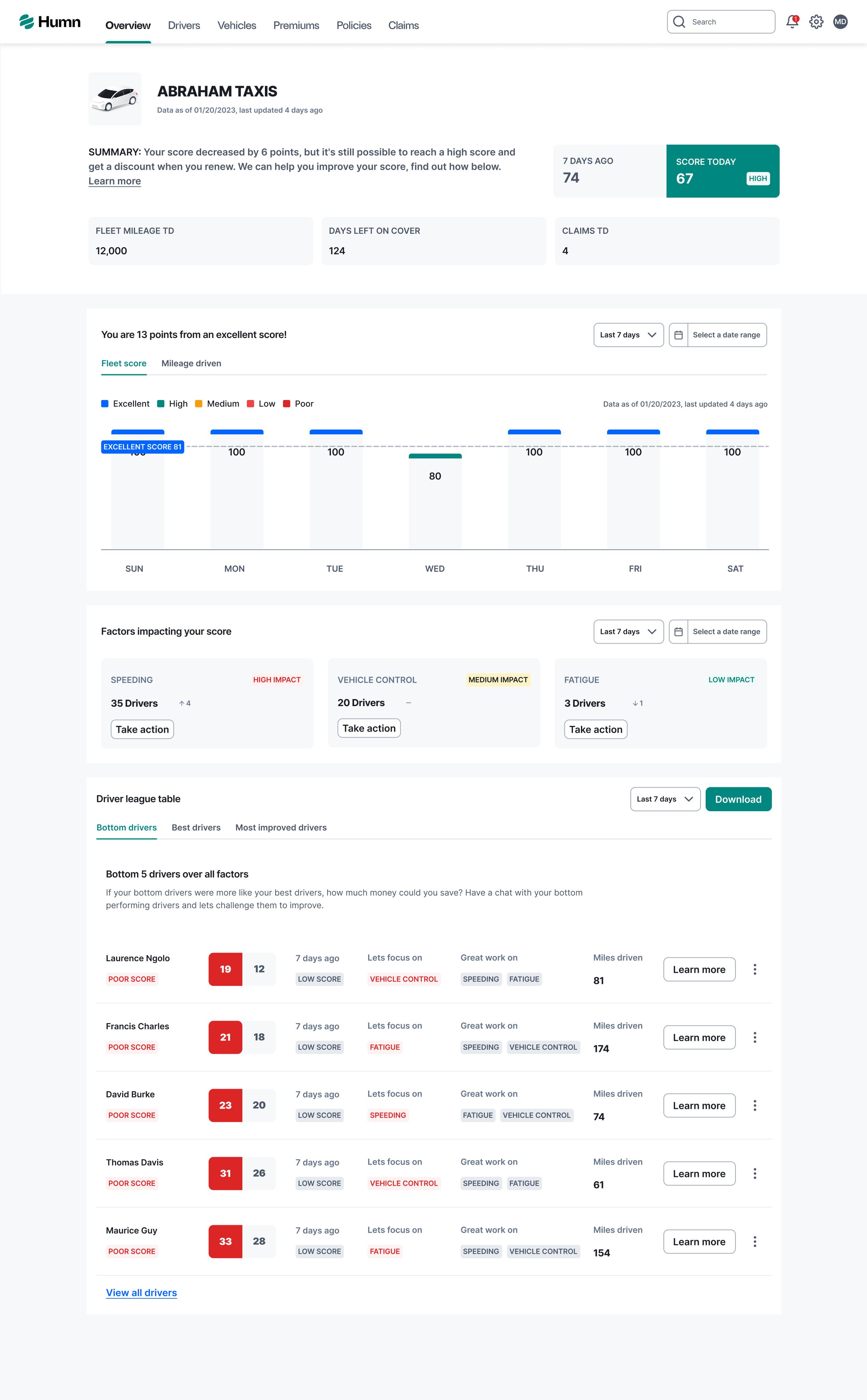

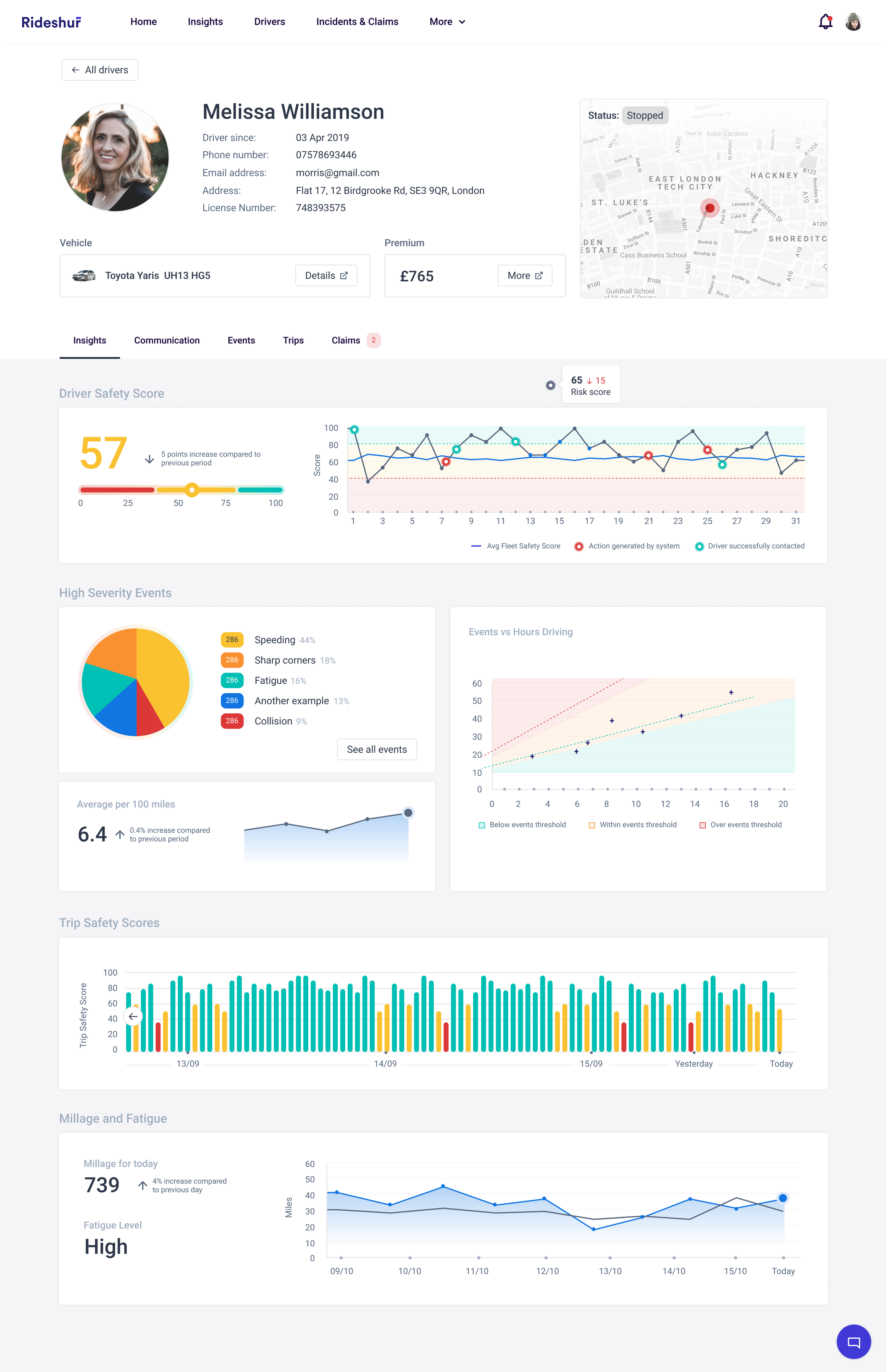

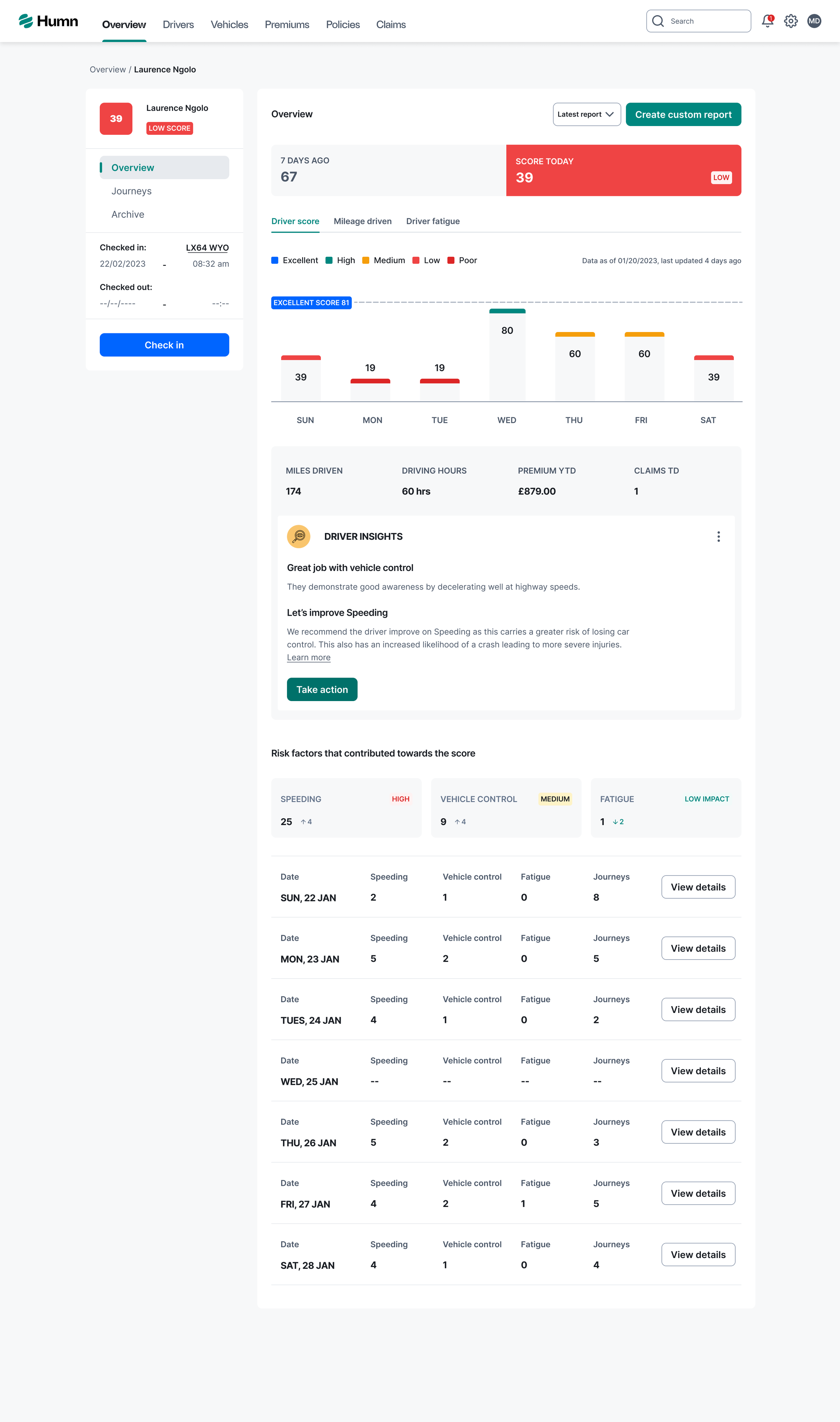

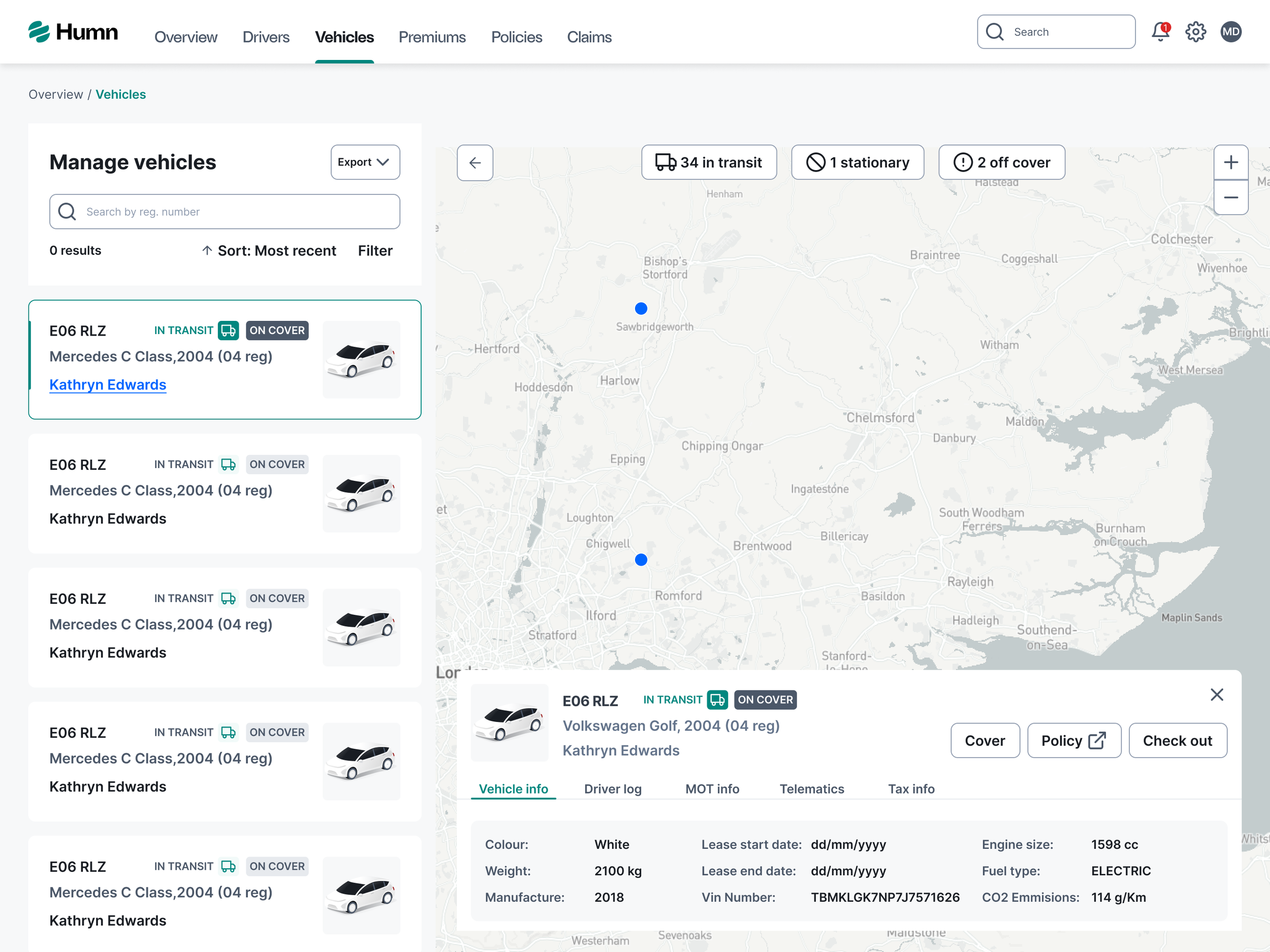

A B2B and B2B2C platform serving fleet managers, drivers, insurers, and brokers, combining telematics, behavioural data, and predictive risk modelling.

Growth-stage insurtech in a regulated insurance ecosystem

AI-driven insights influencing safety outcomes and insurance decisions

Multiple user types with varying levels of data literacy

Increasing commercial traction requiring a more mature product experience.

The Business Problem

As HUMN expanded, users struggled to consistently understand:

What the product was telling them

Why certain behaviours or risks were flagged

What actions they should take next

This created three strategic risks:

Lower retention due to unclear ongoing value

Reduced engagement with key insights

Weakened trust in AI-driven recommendations

Product Context

Product

HUMN Insurtech Platform — delivering behavioural insights and risk intelligence for fleets, drivers, and insurers.

Role

UX Lead — accountable for UX strategy, research direction, design execution, and optimisation across the platform.

Mandate

Scale the product experience to support growth, improve retention, and strengthen trust in AI-driven insights within a regulated environment.

Impact

15% increase in user retention by simplifying end-to-end journeys and clarifying value across core workflows

25% increase in user acquisition supported by clearer onboarding and improved product-market fit

Improved decision confidence through clearer presentation of behavioural risk and AI-driven insights

Reduced friction across key journeys by prioritising usability, accessibility, and consistency

Established scalable UX foundations to support product growth without increasing complexity

Context & Business Stakes

The Scale

Organisation

HUMN — a fast-growing insurtech platform focused on improving driver behaviour, fleet safety, and insurance outcomes using connected data and AI.

Product Environment

A B2B and B2B2C platform serving fleet managers, drivers, insurers, and brokers, combining telematics, behavioural data, and predictive risk modelling.

Operating Context

Growth-stage insurtech in a regulated insurance ecosystem

AI-driven insights influencing safety outcomes and insurance decisions

Multiple user types with varying levels of data literacy

Increasing commercial traction requiring a more mature product experience

The Challenge

As HUMN grew, several risks began to limit adoption, retention, and long-term scalability:

Fragmented end-to-end journeys

Core workflows were inconsistent across the platform, making it harder for users to understand value and complete tasks confidently. This increased friction and weakened retention over time.Unclear insight prioritisation

Data-heavy screens surfaced too much information at once, slowing decision-making and reducing engagement with the most important behavioural and risk signals.Accessibility and usability gaps

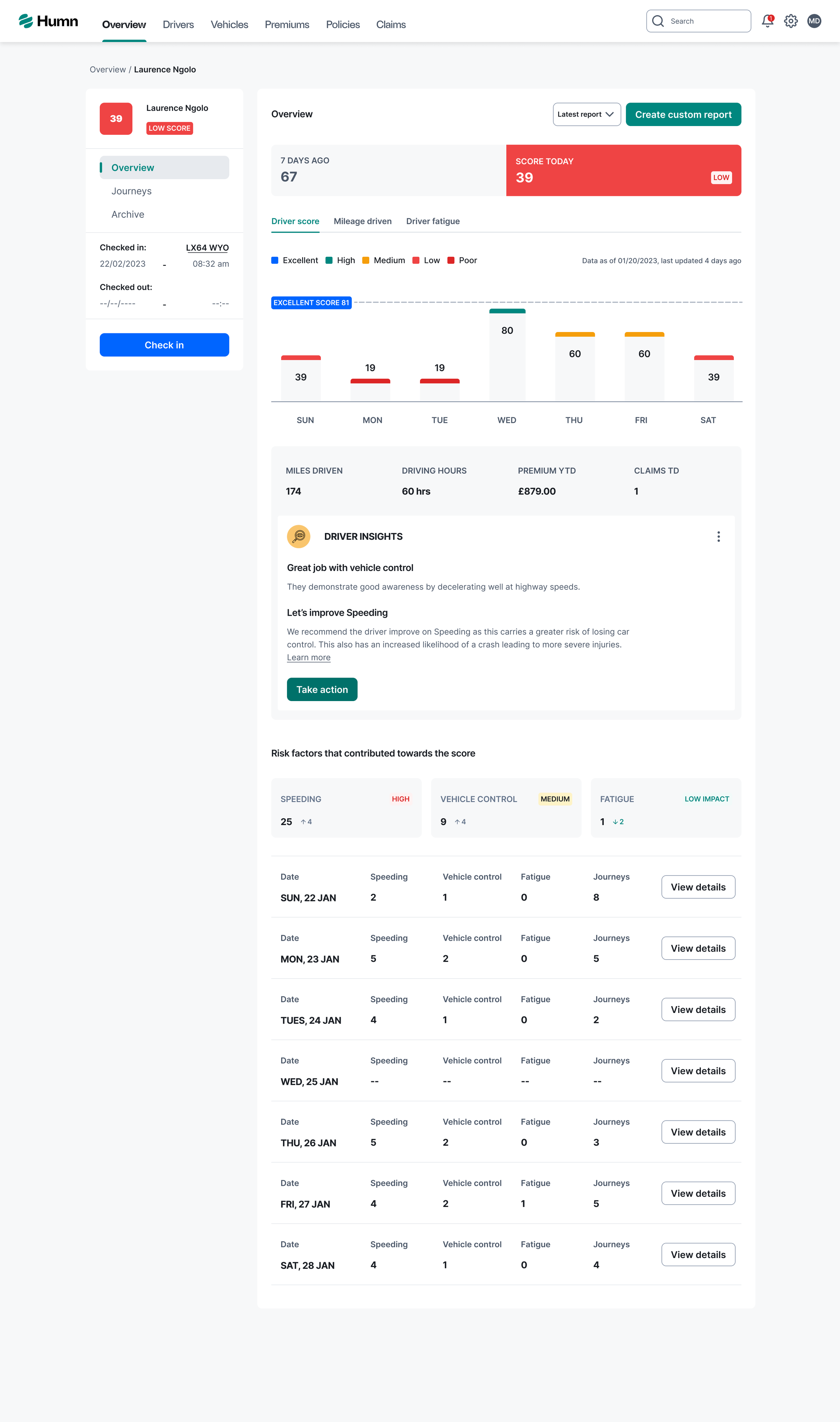

Inconsistent application of accessibility and usability standards created barriers for some users, limiting broader adoption and increasing reliance on support.Opaque AI-driven insights

Behavioural and risk scores lacked sufficient explanation, reducing user confidence in recommendations and making it harder to act on insights.

Left unaddressed, these risks threatened user trust, product adoption, and HUMN’s ability to scale sustainably in a competitive insurtech market.

Research & Insights

-

Research

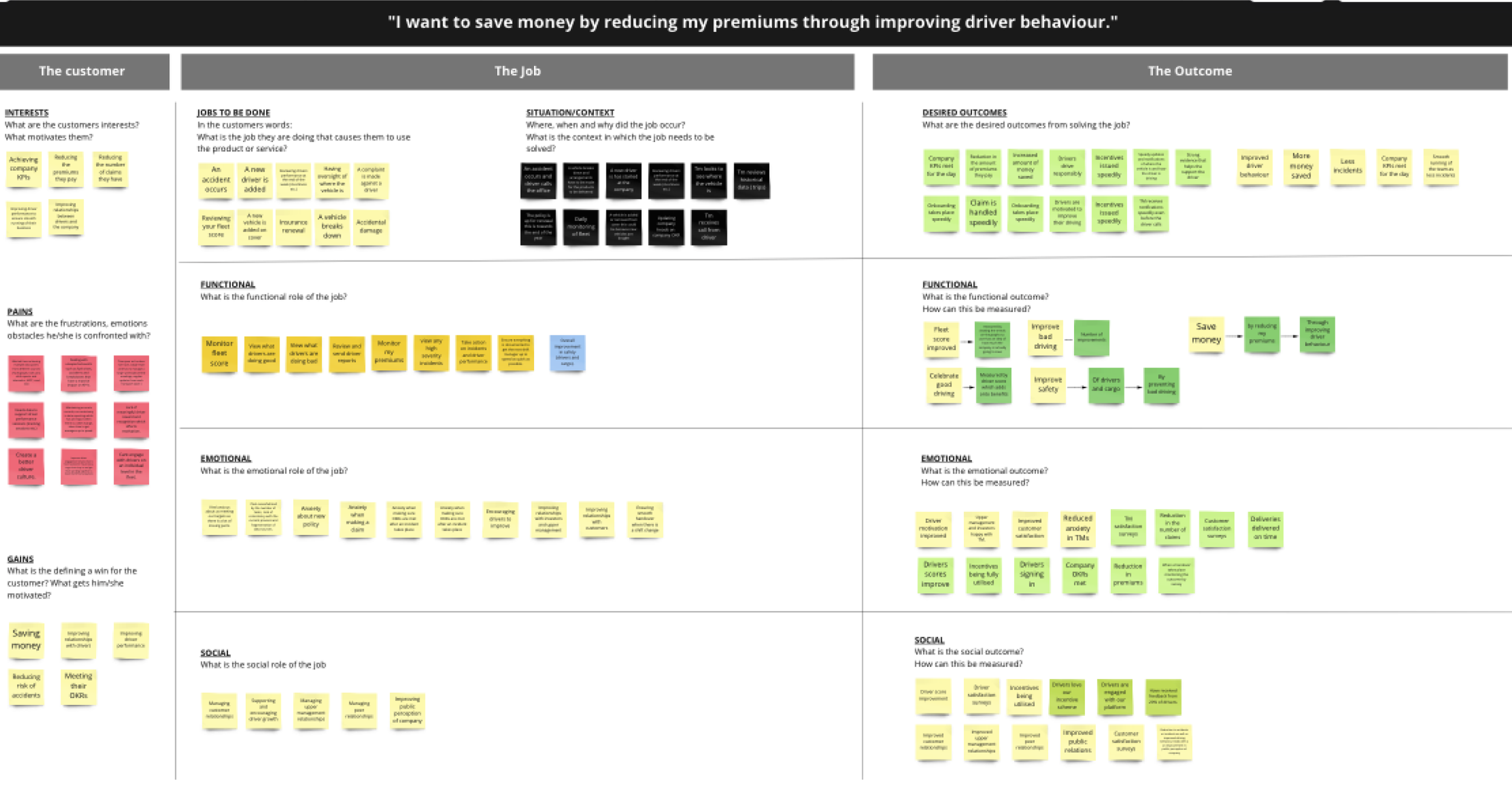

I combined qualitative and quantitative inputs to understand where the experience was breaking down and why.

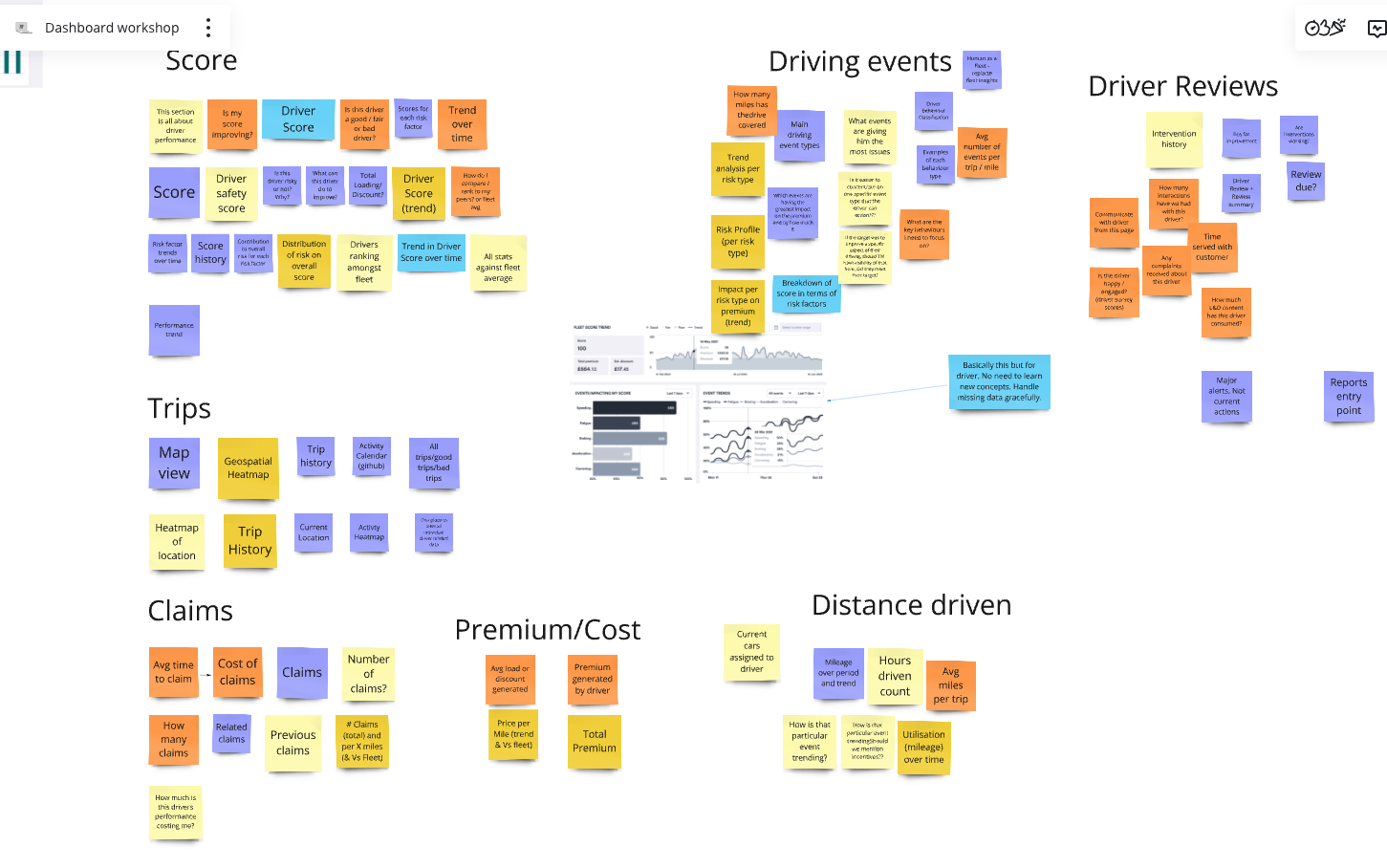

UX audit

Reviewed core workflows to identify usability issues, inconsistencies, and sources of cognitive load.User and stakeholder interviews

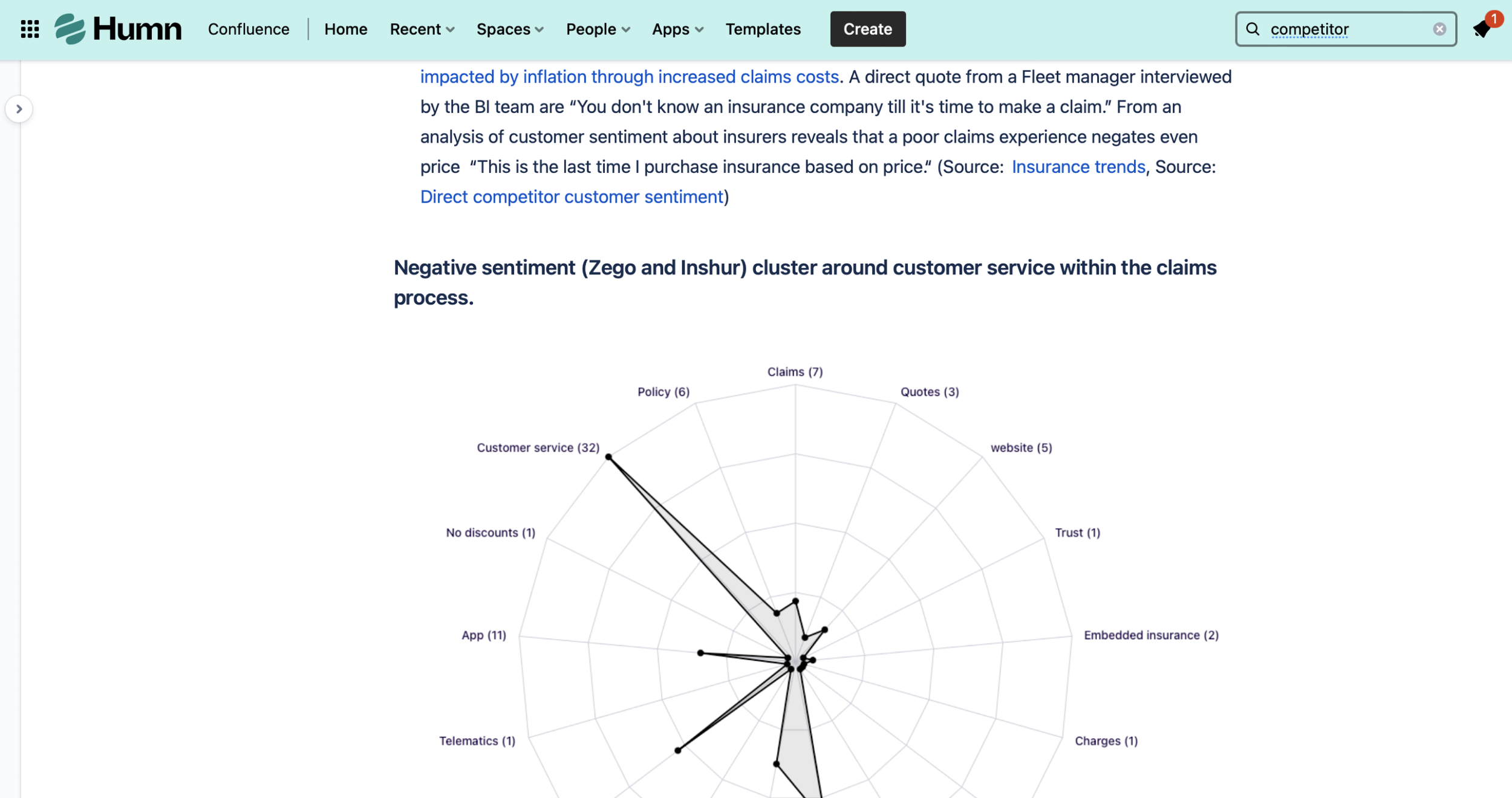

Spoke with fleet managers, internal teams, and customer-facing roles to understand goals, constraints, and recurring pain points.Competitive benchmarking

Analysed comparable fleet risk and analytics platforms to identify industry patterns, gaps, and opportunities for differentiation.Customer success data review

Synthesised support tickets, feedback, and account insights to identify high-friction areas impacting adoption and satisfaction.

-

Strategy

Based on the research, I aligned UX efforts around scalability, clarity, and speed of decision-making.

Established a formal UX function that integrated research and design into product decision-making.

Introduced consistent interaction patterns and foundations to support scalability and reduce UX debt.

Used competitor insights to prioritise areas where clearer insight delivery could differentiate the product.

-

Key Findings

Research surfaced a consistent set of user needs that informed the design strategy:

Users were time-constrained

Fleet managers prioritised fast, scannable insights over comprehensive data views.Progressive disclosure improved comprehension

Surfacing high-level signals first, with detail on demand, reduced cognitive load and improved understanding of risk metrics.Automation reduced manual effort

Automatically generated reports and notifications reduced the need for manual analysis and follow-up.Strong interest in AI, paired with a need for clarity

Users were enthusiastic about AI-driven risk assessments but needed transparent explanations to trust and act on them.

Through user research, usability testing, and cross-functional discovery, I identified three core constraints

1. Insight clarity

Users needed prioritised, actionable insights — not raw behavioural data.

2. Cognitive overload

Too much information was surfaced at once, reducing comprehension and confidence.

3. Opaque intelligence

AI-driven behaviour and risk scoring lacked sufficient explanation to support trust.

Design Strategy

I reframed the UX around clarity, confidence, and continuity, rather than feature completeness.

Strategic Principles

Actionable insights over raw data

Progressive disclosure to manage complexity

Explainable AI as a UX responsibility

Accessibility and consistency as growth enablers

Execution & Leadership

I led UX delivery end-to-end while working closely with product, engineering, and data teams.

Key initiatives included:

Redesigning key journeys to clarify value and next actions

Simplifying dashboards and insight presentation

Introducing consistent interaction patterns across features

Applying accessibility and usability best practices across the platform

Designing clearer explanations for behavioural and risk insights

Supporting onboarding and activation improvements aligned to growth goals

This work balanced short-term gains with long-term scalability, avoiding UX debt as the platform evolved.

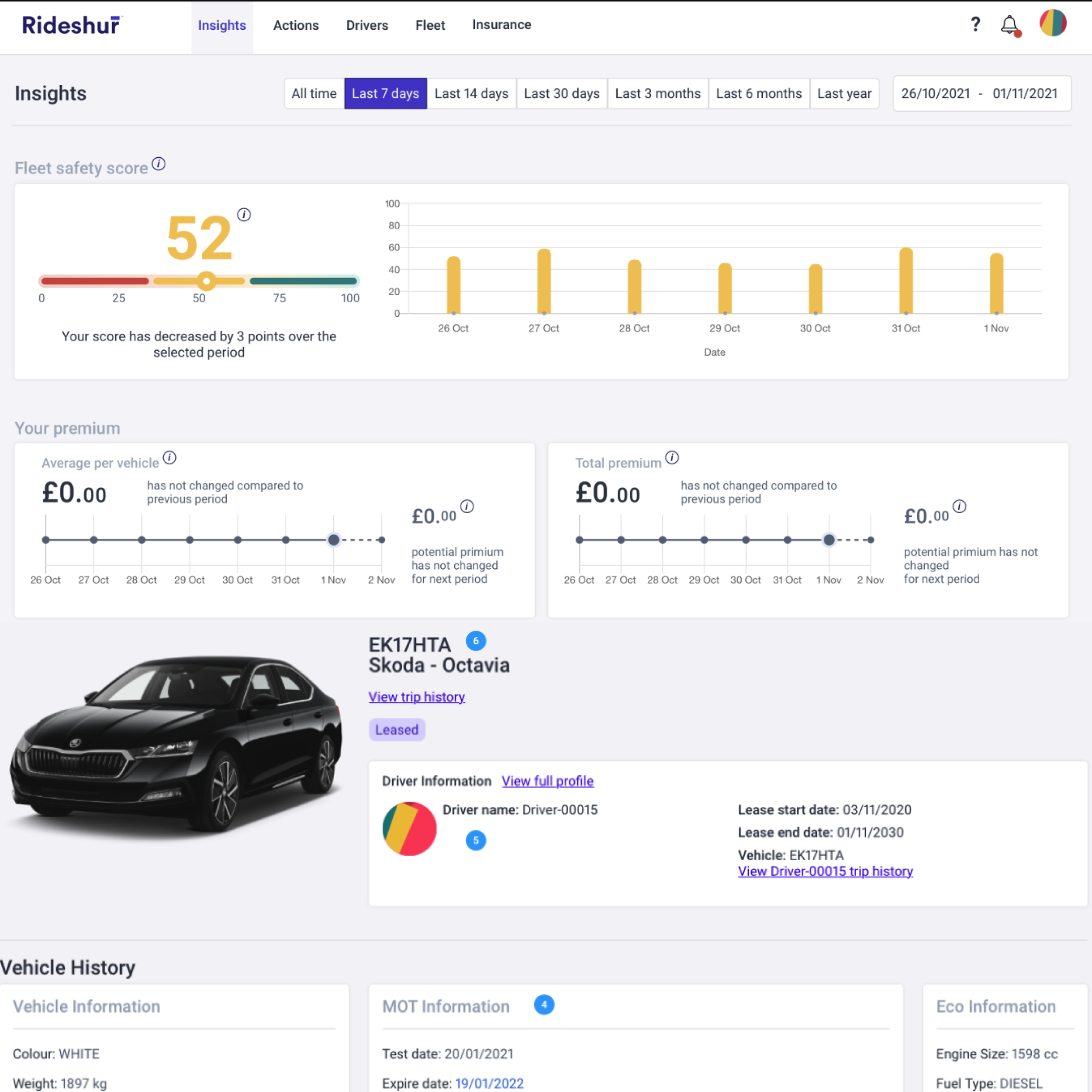

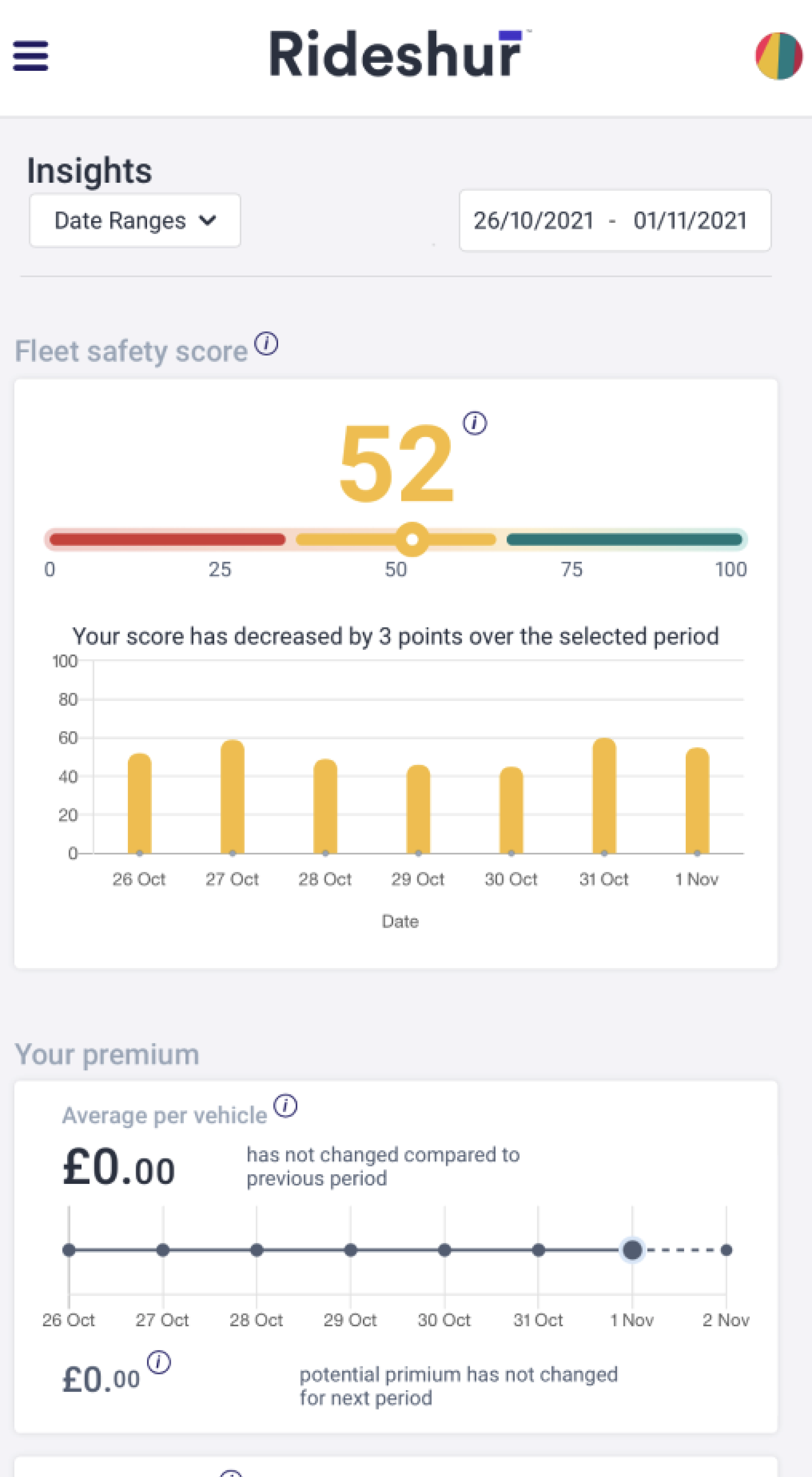

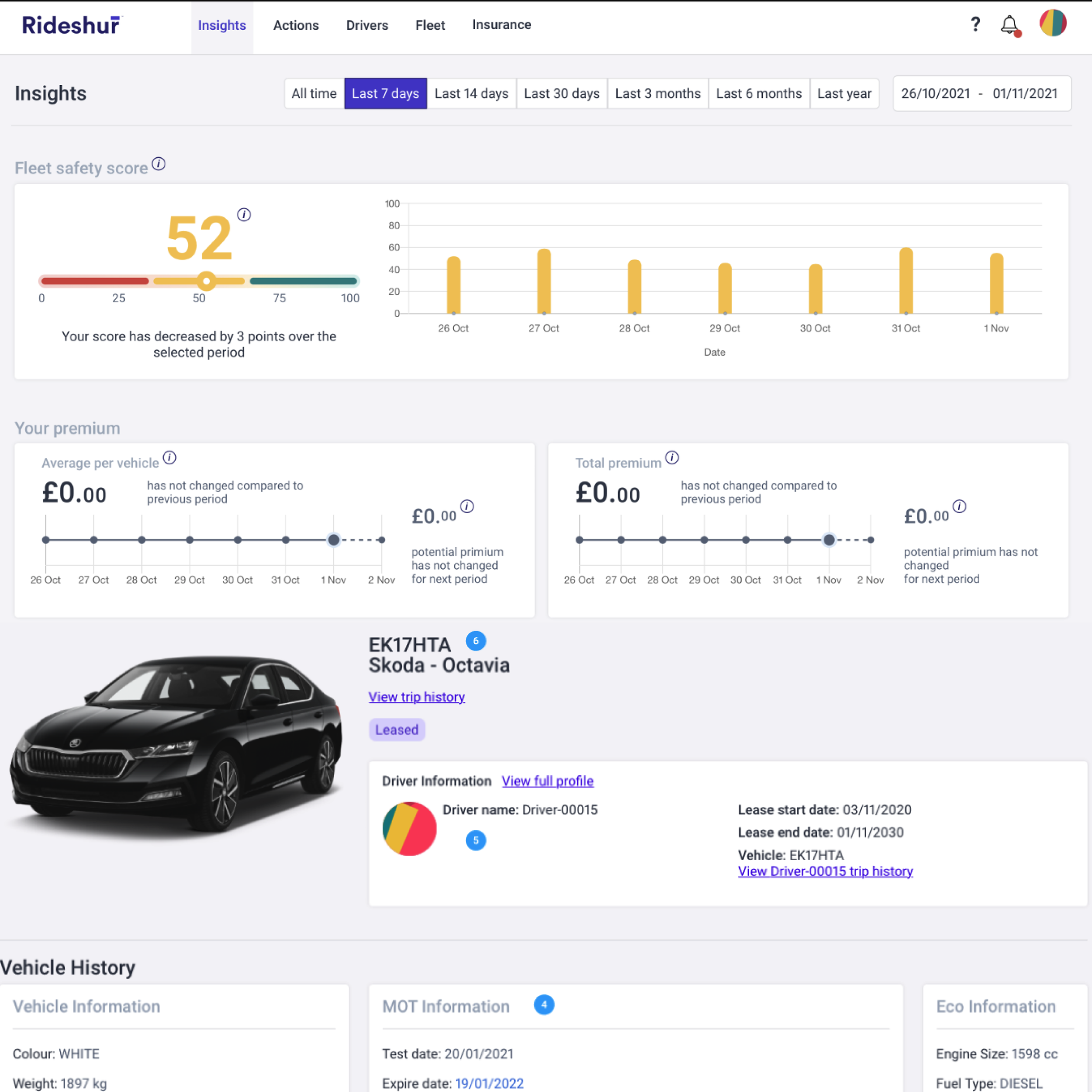

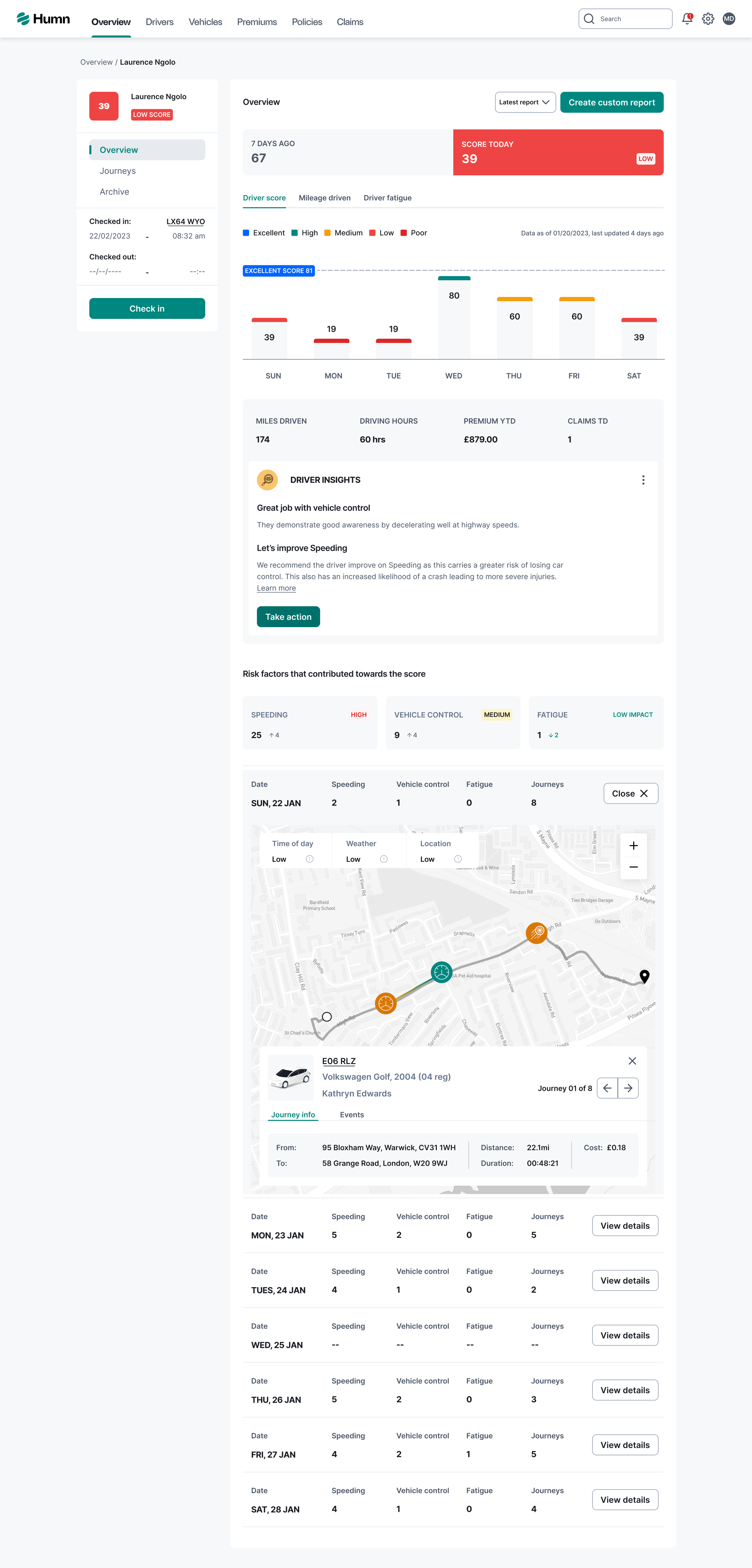

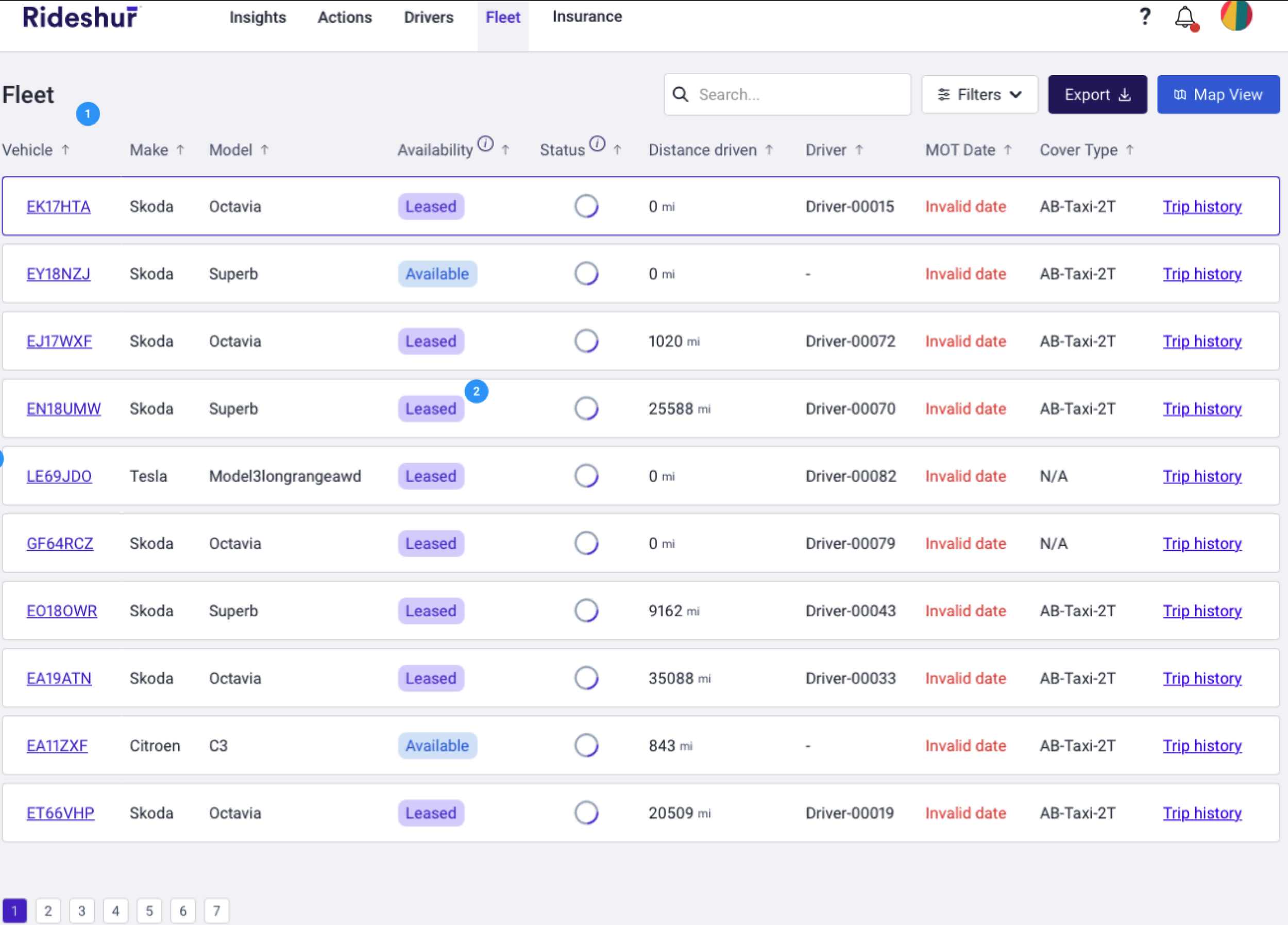

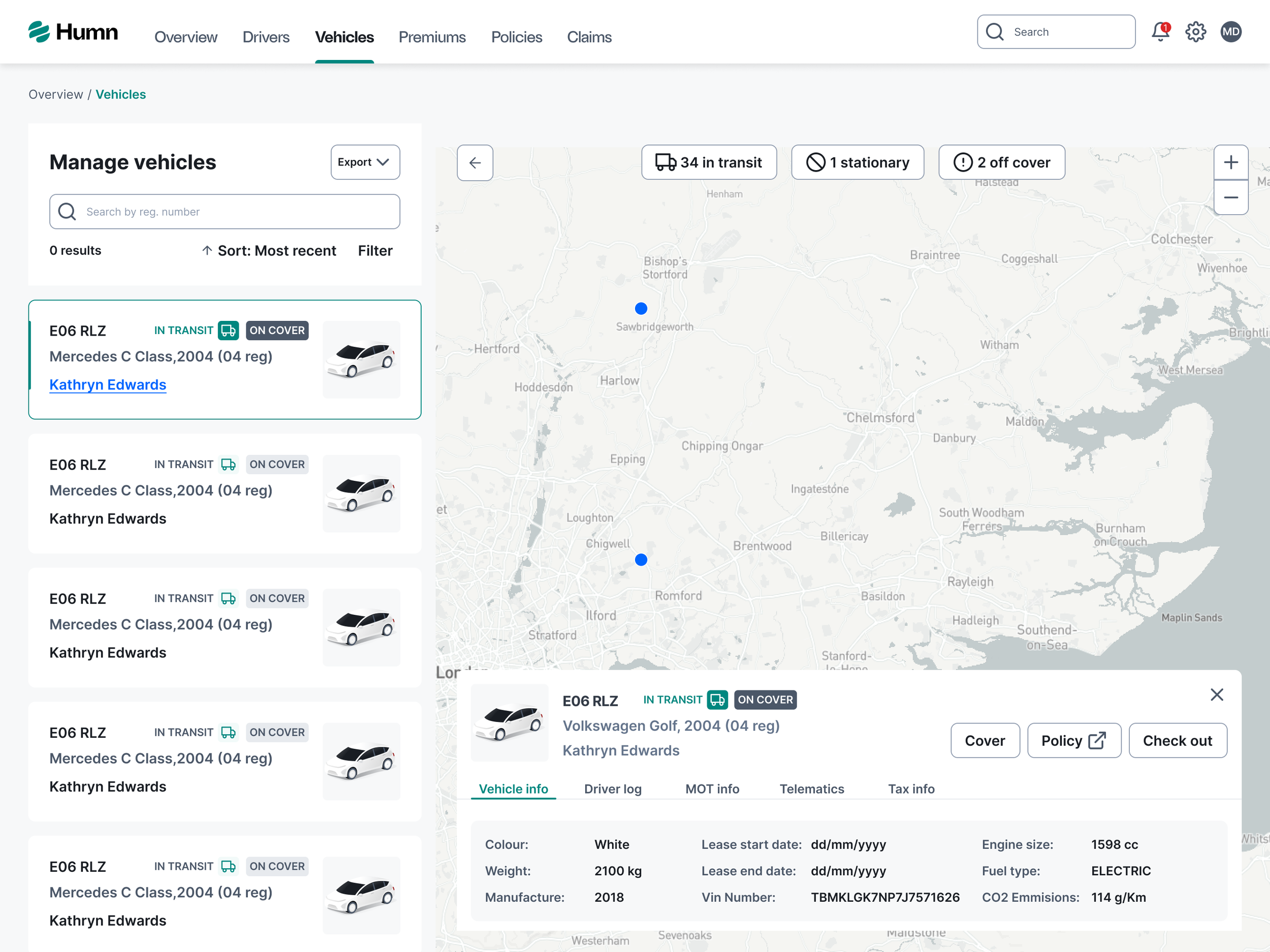

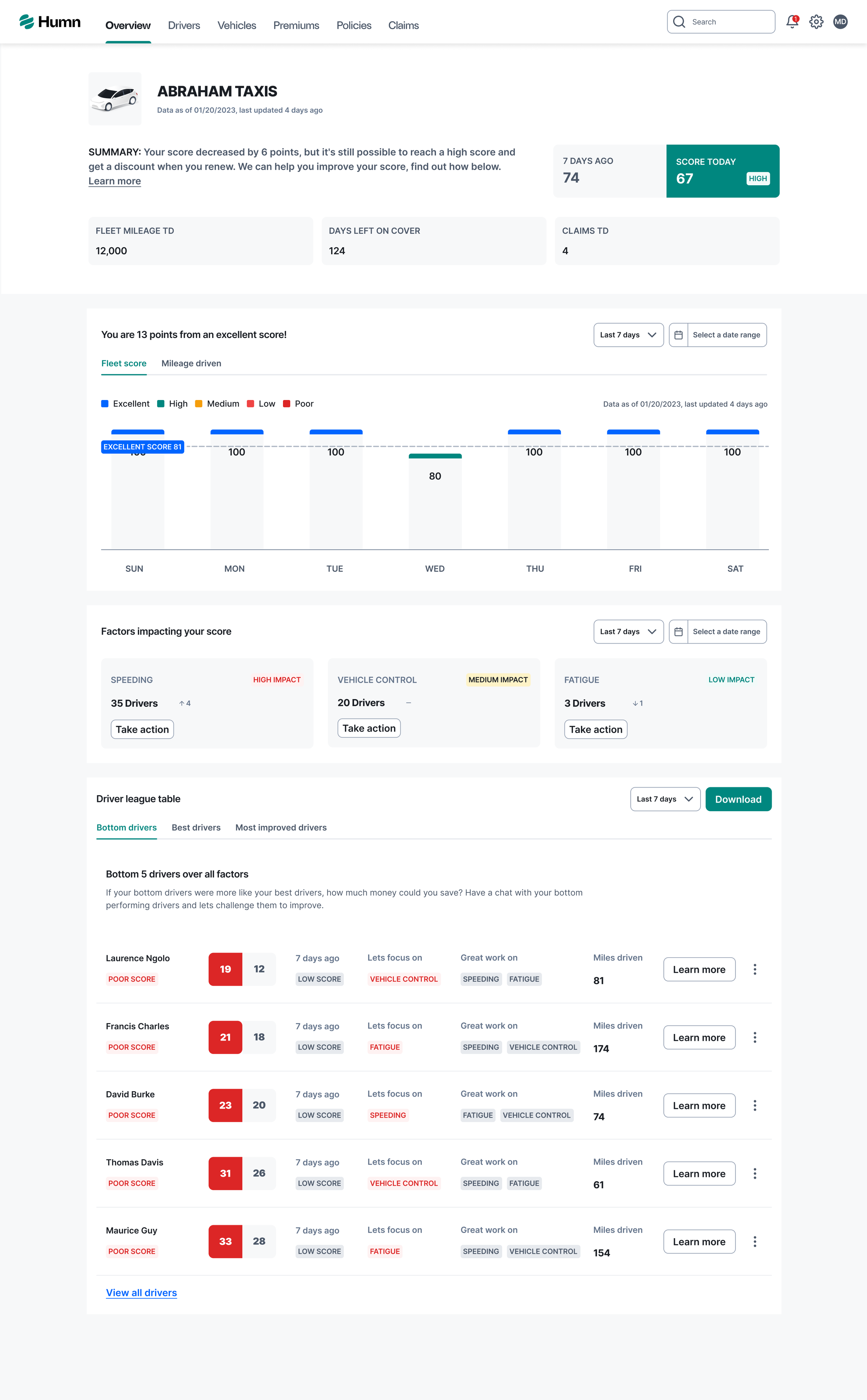

Redesigned pages

Measurement & Validation

Primary metrics

User retention

User acquisition

Engagement with core insights and features

Outcome

15% increase in user retention

25% increase in user acquisition

Improved engagement and clearer understanding of insights, validated through analytics, testing, and user feedback

Outcome

HUMN’s platform matured from a technically capable product into a clearer, more trustworthy experience that could scale with the business.

By improving clarity, consistency, and explainability, the UX now supports:

Stronger user confidence

Improved retention and engagement

A more compelling, growth-ready product proposition

This case demonstrates my ability to:

Lead UX strategy in AI-driven, regulated environments

Scale product experiences without increasing complexity

Translate behavioural and risk data into actionable, trusted insights

Align UX work directly to growth, retention, and product maturity